‘Harbingers of failure’ versus ‘lead customers’: Notes from Tim Harford provoke contrarian thinking

Earlier this month Tim Harford, a Financial Times (TimHarford@ft.com) writer and author of best-selling books ‘The Undercover Economist’ and ‘Fifty Inventions That Shaped the Modern Economy’ – who I rate highly, published an article about losers – in which category he includes himself. These are people who consistently purchase products which most people don’t want.

The piece kicks off with a quote from Steve Eisman, on who the film ‘The Big Short’ was based: ‘’whatever that guy is buying, I want to short it’’. In retail, researchers have found that some consumers are ‘harbingers of failure’, persistently opting for products that will be dropped soon for lack of interest. ‘Lead customers’, on the other hand, tended to be ahead of the trend in successful launches.

What they also found is that the former tended to vote for the losing political candidate, and tended to cluster in certain postcodes. Now we know where Dominic Cummings is coming from!

When I was a money and derivatives broker, I too would classify clients by their choices. The large steady hedger who would deal at certain prices only; the late-comer chasing a mature bull market; the desperado who wants out of a losing trade at any price.

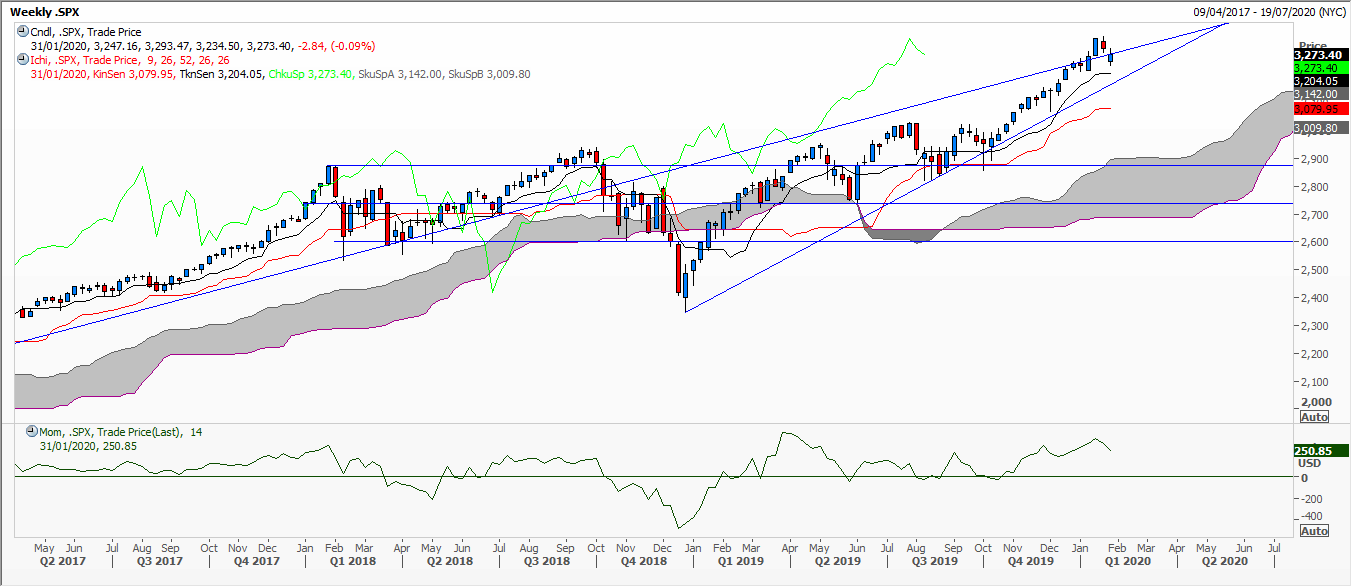

Contrarian thinking is how technical analysts label this. But how do we assess when we are at an extreme? Screaming front-page newspaper headlines are a classic signal. Prices pushing at the edges of a trend channel or Andrews Pitchfork; wedge and diamond chart patterns, not forgetting parabolic rallies.

Oscillators are usually monitored closely for divergence. RSI, momentum, the commodity channel index and Chaikin’s money flow. Candles likewise can warn of extremes, and here I’m thinking specifically of an island reversal, hammer or shooting star.

And finally, when your broker calls you to say you would’ve/could’ve/should’ve done X, Y or Z. Hindsight.

Tags: Contrarian, divergence, Market Signals, Technical Analysis Courses

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

- The Emotional Rollercoaster of Markets: Why Bubbles Repeat and How to Outsmart Them: Summary of Kim Cramer Larsson talk May 14, 2025

Latest Comments