‘The Life Cycle Hypothesis’ – Tony Plummer’s talk and book

Front row seats for veteran technical analysts, Trevor Neil and myself, at this eagerly awaited presentation.

Trevor Neil

WD Gann expert Tony kicked off saying that the US economy has a 36-year cycle. I don’t know what cycle our speaker’s body clock is working on, but both of us agreed it certainly looks good. A seriously slick, clear, up-tempo presentation, timed to perfection, underline just what a pro we have at the society.

He explained that Gann’s ideas, set out in 1927’s ‘The Tunnel Thru the Air’ and then 1950’s ‘The Magic Word’ (ahead of his death in 1955), were, at the time, religiously and socially unacceptable. Therefore much of the writing, pages, size and layout have hidden in them the Golden Mean and the 50 per cent proportion – which he called the law of octaves (the 7 musical notes). He warns that, ‘’markets are not easy, and this [Gann] is no exception to that’’.

Today, society members are totally au fait with Fibonacci ratios, but not so then. The half-way point is important because if the 50 per cent correction level breaks, then it means that the system is changing. The long term phases of Gann’s cycle have specific wave patterns associated with them, and can be divided into sections.

The first half of a secular move is seen as a change in the external structure, the masculine half of the move. What follows later is known as the internal process, and is the feminine half. Within this are 3 equal-sized patterns relating to momentum. Starting with the transition cycle, which eliminates redundant beliefs, we move to a more dynamic transformation cycle which lays down new infrastructure and ends with excesses – but NOT a crash. The final third, known as the termination cycle, is speculative rather than innovative and akin to Elliott’s Wave 5.

He goes on to make predictions for various major markets and economic measures, stressing that current disinflation, which is expected to last until 2019 or 2020, will then cause economic trauma roughly in 2022 and uncontrollable inflation after 2023.

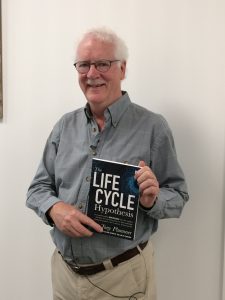

Tony Plummer – buy the book!

This is a talk where the video, available to members on the STA website, really comes into its own. Watch, pause and re-run the bits you didn’t quite catch or to look at the many interesting historical charts he shared with us. Alternatively, buy his book!

Tags: Gann, Golden Mean, Life Cycle hypothesis

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating Mid-2025: Inflation, Markets, Commodities & Strategic Outlooks July 10, 2025

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

Latest Comments