Pattern recognition: Man versus machine

To coincide with St Patrick’s Day last week Scientific American posted on social media a short video to help you spot a four-leaf clover. Presented by a self-confessed egg-head, the focus is on pattern recognition and how science can help improve the odds of success while acknowledging that chance, skill and statistics all have a part to play. All the more relevant following the challenge between Google’s AlphaGo which proved more than a match for some of the world’s best players, most recently South Korean master Lee Se-dol who was three games down before a win.

Click this link to view http://bit.ly/1Rw5vOn

I have first hand experience of Artificial Intelligence being used to spot chart patterns since at least the mid-1980s. To be honest, the results were touch and go and of dubious predictive value. Obviously machines and software have come on in leaps and bounds – yet the Chinese doubt that their traditional game of Mah-jong, with fewer outcomes but where more luck is involved, will ever succumb to a computer win. The gauntlet has been thrown down.

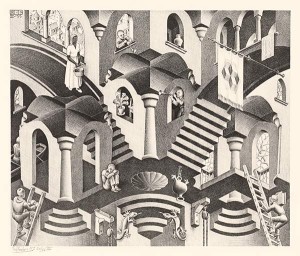

But it’s interesting to see how when scanning mammograms a trained radiologist works so much more efficiently than the odds might indicate. Similarly a sailor trained to use radar and sonar will very quickly focus in on the deviations and ignore ‘noise’ and the humdrum. Likewise an experienced technical analyst is able to scan hundreds of charts and home in on the most interesting.

Funnily enough it seems that speed during the selection procedure actually improves results – the ‘quick scan’ approach; as a keen chart pattern analyst I have always been a great believer in this method. Of course it requires hard work, but never let that put you off. I still remember flicking through my Chart Analysis books and weekly issues of Commodity Perspective, finding the exercise so useful that I have set up my current graphics packages to reflect that daily overview process. Small charts, and lots of them, arranged for the fastest possible flip-through.

Throw caution to the wind and try it yourself, then use a timer to shave seconds off your process every day. Remember, you then can go back to look at the star performers in greater detail, and at your leisure.

Tags: artificial intelligence, Chart patterns, recognition

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating Mid-2025: Inflation, Markets, Commodities & Strategic Outlooks July 10, 2025

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

Latest Comments