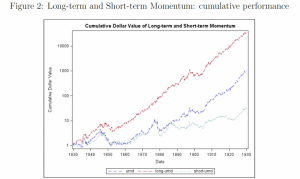

Momentum, Echo and Predictability: Evidence from the London Stock Exchange (1820-1930): Eye catching, as one doesn’t often see stock charts this old

One of the ‘advantages’ of being a journalist is the vast amounts of unsolicited email I receive. The other is that I spend a lot of time on social media and websites looking for information, finding what’s new, and what might be interesting to my readers. Most of the incoming emails are mere hopeful requests for a plug for a product, person, or investment opportunity. I tend to steer clear. My research digs up dodgy sites and dubious information – but we all know about ‘fake news’ by now. Sometimes things take a positive turn, like when I stumbled on ‘Investor Amnesia’ with the tag-line ‘we’ve been here before’. The title of this blog comes thanks to them. To contact them you can use this link: jamie@investoramnesia.com

‘Momentum investing’ is today’s buzzword, beloved of the index-tracking, Exchange Traded Fund, penny pinching stock-trading community. What they really mean is that stock-pickers are a waste of time and money, and that what you should be doing is jumping on the bandwagon and holding on for dear life.

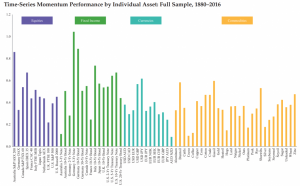

Not so, according to the article, where again I’m attaching a link so you can read it in full and view the accompanying – fascinating – charts. ‘’We conclude from our analysis that Fama-French factors – especially size and market – as well as momentum account for some of the cross section variation in stocks. Momentum is the most profitable factor, as well as the riskiest. Momentum returns resemble an echo: they are large for long-term formation periods of 12 to 7 months, while they vanish for shorter term formation periods.’’

https://investoramnesia.com/2019/10/20/psychology-trend-following-real-estate-momentum/

Technical analysts think of momentum quite differently. John Murphy, in his essential ‘Technical Analysis’ series of key works, puts measuring momentum in his chapter on Oscillators and Contrary Opinion; I certainly use this rate-of-change gauge daily. Martin J Pring in his ‘technical Analysis Explained’ goes one step further dedicating a whole chapter to Momentum Principles which he believes to be a Major Technical Principle (his bold font). I, for one, hope momentum will keep driving me on.

Tags: Amensia, Compounding, Contrary Opinion, momentum, Technical Analysis Courses

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments