Don’t get bogged down watching the same old markets: Broaden your horizons and add to your knowledge

A famous quote I love is this one from Eleanor Roosevelt: ‘I think, at a child’s birth, if a mother could ask a fairy godmother to endow it with the most useful gift, that gift should be curiosity.’ A firm believer in this myself, I think it’s what drives me to read widely, with an open mind, and to explore different avenues which may, or may not, lead to greater understanding. While by profession I am a technical analyst and specialist financial writer, I most certainly do not limit my research to these topics.

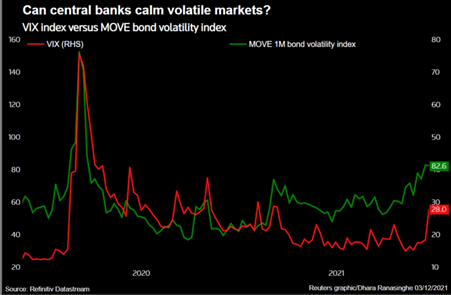

The fun bit is that you’ll never know what nuggets may turn up, and how you might incorporate them into your thinking. Being keen on international bond markets, one of the journalists I have followed for many years is Dhara Ranasinghe, Senior European Bond Correspondent for Thomson Reuters. This week her focus was on upcoming central bank meetings ahead of the Christmas break, their so-called ‘guidance’ as to their next interest rate moves, and the volatility this has created in some markets recently.

Below you’ll see the chart that caught my eye. It compares the imputed one-month volatility of the US S&P index (VIX) and the index of volatility on US Treasuries, as calculated for the ICE by Bank of America; its mnemonic on Refinitiv is .MOVE

I attach a link to Dhara’s piece.

https://lnkd.in/d93fwtY9

I now realise that there is considerable history to this index, but I wasn’t aware of it; live and learn. My second chart is that of .MOVE itself, with history available to me going back to 2003. You can see that while the bond index has indeed picked up steadily over the last 18 months, it’s still well below the high in 2020 and the record reached in the great financial crisis of 2007-2009.

Tags: Education, Indices, volatility

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Navigating Mid-2025: Inflation, Markets, Commodities & Strategic Outlooks July 10, 2025

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

Latest Comments