Shifting time: And changing expectations

This month my focus has been on sovereign bonds. I am not alone here and one of the salient and frightening things is just how few people understand this investment vehicle. Because of this most retail investors have missed out on the bond bull market (and trend to lower yields) over the last 35 years. My column last week for the Investors Chronicle was entitled ‘Better a bond in the hand’, prompted by recent data from G4 countries’ (US, UK, Japan and Eurozone) pension funds showing almost half their holdings were in fixed-income products.

Meanwhile in Sintra this week central bankers tried to outdo each other in their warnings on interest rate rises, Canada’s Poloz claiming a more hawkish crown than either the ECB’s Draghi or the Bank of England’s Carney, while the Fed’s Yellen said ‘I don’t believe we will see another [financial] crisis in our lifetime’. Famous last words, maybe, as simultaneously sovereign yield curves in major countries are at their flattest in a decade.

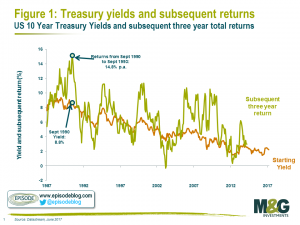

The bond vigilantes march on, M&G Investments producing some of the most interesting and readable research. In a recent piece by Alex Houlding, aimed at investment professionals, they looked not at yield to maturity but total return (coupons plus price appreciation/depreciation) over a three-year period – over the last 30 years’ worth of US Treasury data.

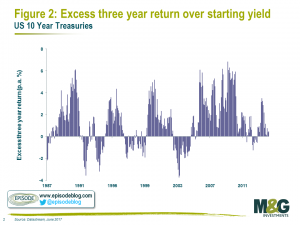

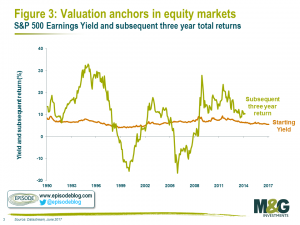

The first chart plots the current yield to maturity of ten-year Treasury Notes, then the green line mapping the total returns achieved three years after that. Cashing in, you would then rebalance your holdings to get back to a ten year maturity. The histogram shows whether you made or lost money, and how much, had you held the paper for just three years of its ten-year life. They conclude that most of the time since 1987 you would have been pleasantly surprised. The reason for this is that the starting yield acts as one’s ‘anchor’ of expected returns, but in actual fact achieved returns vary far more significantly, especially in the US equity market.

I hope you will be able to use the link below to read the full text.

https://www.episodeblog.com/2017/06/23/yields-uncertainty-expected-returns/

Tags: bonds, return, yield to maturity

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

- The Emotional Rollercoaster of Markets: Why Bubbles Repeat and How to Outsmart Them: Summary of Kim Cramer Larsson talk May 14, 2025

Latest Comments