Have Central Banks tamed inflation? Or are they to blame for the whole fiasco?

Within the last few days the European Central Bank and the People’s Bank of China trimmed their key interest rates once again. In Britain annualised consumer price inflation suddenly dropped from 2.2% in August to 1.7% in September 2024, below the Bank of England’s target rate of 2.0% and the lowest level since April 2021. Needless to say this has increased talk about the possibility of more cuts to their Bank Rate by the end of this year.

In fact speculation around the absolute level of short term policy interest rates, direction of potential moves and the speed of these has dominated financial market moves since spring, taking implied volatility on US  Treasury notes to the highest levels in many years. Some financial journalists have even started suggesting we should re-think the safe haven status of fixed income products.

Treasury notes to the highest levels in many years. Some financial journalists have even started suggesting we should re-think the safe haven status of fixed income products.

First things first. Blame it on whatever you want, but inflation in the developed world soared around the time that Covid hit. Nobody did anything about in until at least two years later; somebody was asleep at the wheel. From highs unheard of in decades, price rises are now abating to the relief of most.

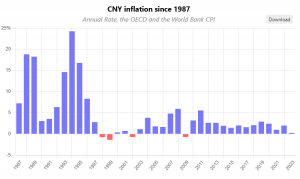

But what if we face deflation? Will the authorities think this is ‘a good thing’, exonerating them from previous mistakes? Look at the long term chart of inflation in the People’s Republic of China. Retail price inflation has been below 5.0% for nearly all of the 21st century. Cautionary note: in the late 1980s and mid 1990s it almost hit 25.0%.

You will also see periods of negative inflation – when tomorrow you can buy more, or better, than you can today. Conversely debt you hold today will grow in value, becoming an even bigger burden especially to fledgling companies and government borrowers. Think carefully how this might impact your choices; how would your business cope; where will people save their appreciating fiat money. It’s a situation not seen in many countries ever, or only rarely in some, so individuals are likely to be ill-prepared for such an event. And how long might it last?

Tags: inflation, interest, pricing, return

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- How I Used Dow Theory to Strengthen My Market Convictions June 20, 2025

- The New Monetary Order: Russell Napier on Inflation, Debt, and Financial Repression June 12, 2025

- Why I Became (and remain) a Member of the STA May 29, 2025

- The Emotional Rollercoaster of Markets: Why Bubbles Repeat and How to Outsmart Them: Summary of Kim Cramer Larsson talk May 14, 2025

- Avoid Overusing Indicators: Streamline Your Trading Strategy May 7, 2025

Latest Comments