‘Fake News’ in focus: Traders and investors, beware

In a week when even President Trump was called out for spreading dubious facts on social media, you know that the format has a big problem. The obvious scare-mongering is often easy to spot, and we all know that screaming headlines sell newspapers. But when it comes to the coverage of financial markets, the economy, and long term trends, the record is truly terrible.

The current meme – that ‘the market’ has become dissociated from ‘the economy’ – is really winding me up. The pathetic level of research, and the sloppy reports, can only be blamed on lazy editors. No fact-checking, no spelling and grammar nit-picking, nothing; just the urge to quickly get ‘content’ out there.

First: the US stock market is not ‘the market’. There is cash, fixed income, FX, commodities, real-estate and art, all of which interact to reflect current conditions and potential shifts in expectations and trends. ‘The economy’ is not USA Inc. Though still just hanging on to its top dog country status, it’s merely a question of time before China, with the biggest population in the world, should by rights overtake it. Furthermore, the scribes are really only looking at the Nasdaq index – and we all know exactly which handful of firms are doing the heavy lifting.

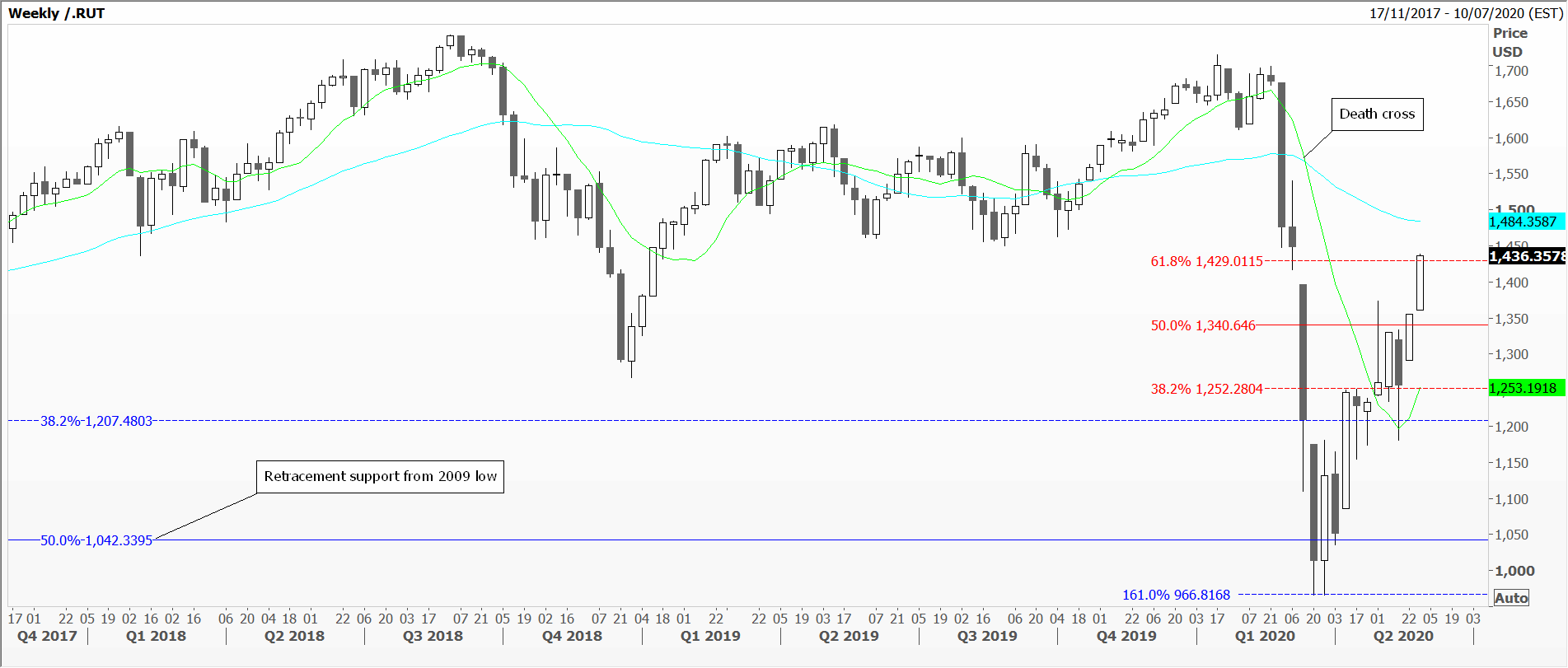

So today, coinciding with an interview done for the Investing Channel, I look at 3 other indices: Russell 2000, Madrid’s Ibex, and Mexico’s IPC. March 2020 was clearly a bad month for all of them, some giving up half of all the gains since 2009’s low in one fell swoop. All 3 have seen a death crosses – when the 50-day moving average drops below the 200-day one and both are dipping lower. Subsequent rallies are within traditional retracement parameters, and all remain below the 200-day one. Mexico peaked in 2017, Spain in 2007, and we’re nowhere near those lofty highs.

I’m tempted to say, they’re reflecting the new reality and waiting it out to see what the long-term consequences of the pandemic, and it’s casualties, will be.

Tags: Falls versus rallies, Financial media, Record highs

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments