Don’t cry for me Argentina: Just look at our stock market

I’ve gone and given the game away. I was going to get you to guess what my first chart was about, but was too tempted to use the line Elaine Page sang in her iconic role in the musical Evita by Andrew Lloyd Webber and Tim Rice – forty years ago now, about something which happened forty years earlier.

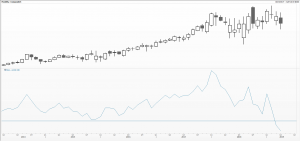

Argentina’s key Merval stock market index, you might be surprised to hear considering the fact the nation has just, once again, gone begging bowl in hand for another $56 billion IMF bailout, set a new record high this year. It’s therefore one of an elite group, including the S&P 500 and the Swiss Market index, suggesting quality status.

Perhaps, taking inspiration from Greece which wriggled out of the IMF and EU fiscal shackles last month, things are not exactly as they seem. First of all, share ownership and banking more generally form a tiny portion of this G20 economy, both are avoided and vilified by the local population.

Inflation is currently running at 55 per cent (according to suspect official statistics) so, unless the index has rallied by this much over the last 12 months, you’re down – but not out. Because of this the Argentine peso in April reached its weakest ever against the US dollar – something unthinkable quite a few years ago when they were pegged one-to-one.

In order to take these issues into account the sub-chart shows the value of the Merval index divided by the exchange rate. I believe FX is not an asset class, but an overlay. A similarly extreme story was seen in Zimbabwe some years ago when inflation hit 1000 per cent, and interest rates were the highest in the world; no assets kept pace with the value destruction. The same has been happening in Venezuela more recently.

My second chart is of the peso/USD exchange rate – the prime mover of the price of everything in Argentina, where quoting in USD has been the norm for decades – except those deemed essential for human survival and subject to governmental price controls. Good luck!

Reporting in today’s Financial Times Guillermo Tolosa of Oxford Economics says: ‘’By changing [the central bank] policy stance so often, it sends a signal that they are not self-confident in their own plan.’’

I’d suggest sticking to the charts.

Tags: Currency Overlay, inflation, Stocks, Technical Analysis Courses

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments