‘Central banks need to show a bit more imagination’: Says ex-Bank of England chief economist Andy Haldane

Now multi-tasking, this ex-chief economist claims, ‘I love inflation targets, having been involved in their design and implementation…for more than 30 years’. Writing in the Weekend FT on the 4th March his article so incensed me that I decided to keep my reaction for a later date. I have learnt this the hard way via financial media contact for nearly as long as Mr Haldane had been at the Old Lady of Threadneedle Street.

This is especially the case in social media, where the devices distributing the information and messages seem to have an in-built device urging immediate, and often knee-jerk responses. Don’t be tempted; wait at least 24 hours before reacting or you might regret what is now in print for all and sundry to pick over.

Events have somewhat overtaken the economist’s newspaper article as on Thursday March 9th rumours of problems at Silicon Valley Bank in the USA surfaced, the Fed closing it down the very next day, and HSBC paying £1 early Monday (13th) for its UK arm. The core to the bank’s cash-flow problems was that central bank mandated interest rate hikes had seriously eroded their bond holding’s value.

Mr Haldane twice in his article talks of ‘mini-monetary mistakes’. The ‘shift upward in the equilibrium price level [since 2022]’ reverses ‘inflation persistently undershooting its target’ during the post-war golden age. Really? Note the oil price crises of the 1970s, hyper-inflation and sovereign debt defaults in many emerging markets.

His three potential responses to today’s problem 1) that UK inflation, at its highest in four decades, is due to ‘unexpected price surprises’. 2) One can shift the Bank’s inflation target higher and 3) extend the time horizon, or temporarily suspend inflation targets (his preferred option).

I’m glad to see I’m not the only one choking on this rubbish. In the Letters section of Weekend FT 11th March Stephen King, Senior Economic Adviser at HSBC, wrote in a piece entitled ‘Inflation makes the global local and the transitory persistent’, commenting that as an inflation lover Mr Haldane ‘is fickle at best’. That he should explain why, after doing their level best to prevent globalised deflation, they (central bankers) should now tolerate surging inflation. Mr King continues: ‘Yet suspending inflation targeting while offering no alternative nominal framework smacks of extending tolerance too far.’

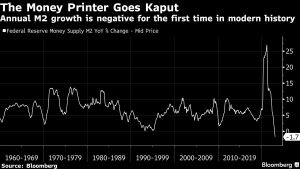

I include a chart of US M2 money supply, at one point the key target for monetarists and central bankers.

Tags: Central banks, inflation, money supply, targets

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments