Torrid time for Ms Truss and Co: Sterling markets in the eye of the storm

On Thursday the 7th July 2022 Boris Johnson resigned. Since then Britain has been pretty much rudderless with an ugly beauty contest for who was to be the next Prime Minister, no Queen and a country in mourning, a long-in-the-tooth King-in-waiting, and some of the biggest Union strikes in decades. No wonder all things sterling have suffered this summer. Now we’re supposed to be back at school but Parliament is in recess because it’s party conference season – which isn’t exactly going well for the Conservatives.

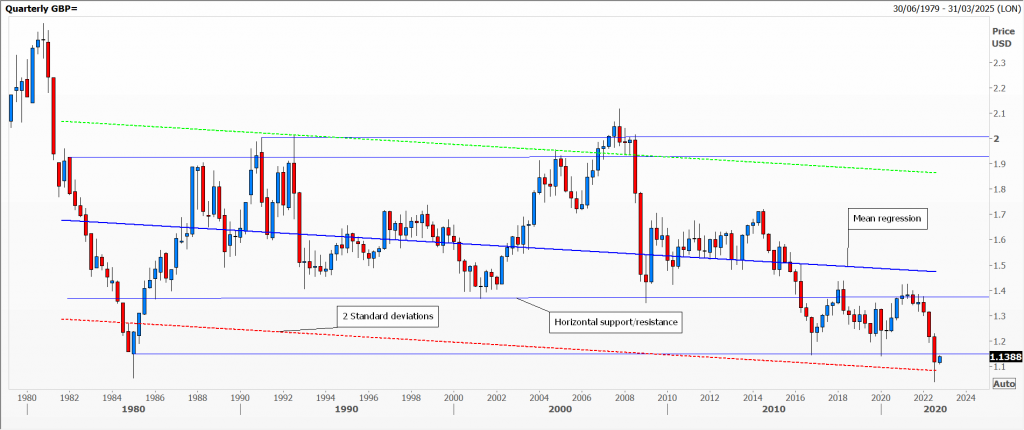

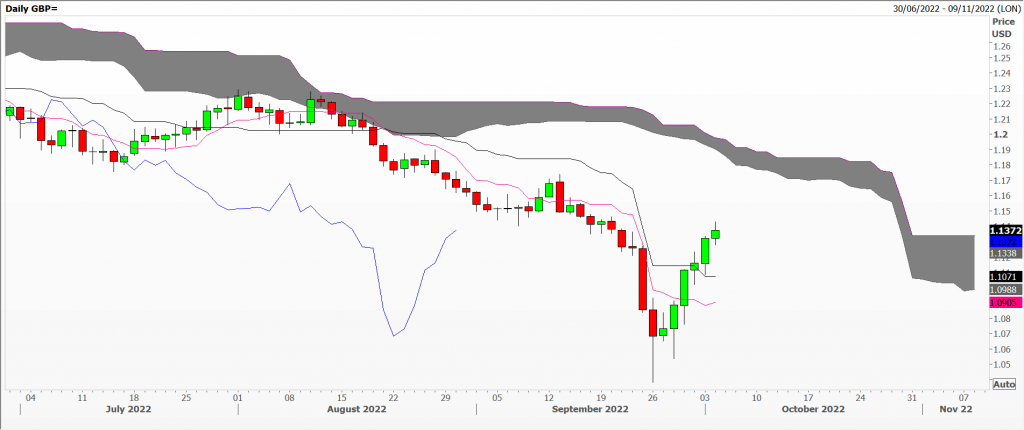

The media has had a field day recently, especially as the pound against the US dollar is traditionally the world’s most hated currency. (See the difference between call and put implied volatility in Chart 2). Yes, late September cable (which Refinitiv has a low at $1.0382) was at a record low, off 21.7% this year, one among many weaklings against an astoundingly strong greenback.Not to be outdone, the long end of the Gilt yield curve (both conventional and index-linked) took fright, forcing the Bank of England to prop these up to steady pension funds. In turn mortgage providers withdrew offers. You really couldn’t make this up.

But look above the parapet for a moment and you’ll see that as well as the pound, the Indian rupee, Philippine peso, Swedish krona (-24.7%), Turkish lira and not forgetting the Argentine peso – the last two are off 41.3% and 44.3% respectively this year against the US dollar – are all at their weakest ever. Ironically the only currencies that have strengthened are the Brazilian real (+9.1%) and the Mexican peso (+2.6%) – plus the Russian rouble, up by 19.5% against its arch-enemy the United States dollar, turning economic theory inside-out, albeit in a very restricted and sanctioned market.

As for the losers, the list is very comprehensive. Of the currencies and many things I follow, the Hungarian forint (-33.1%) and Polish zloty (-23.1%) and have also seen their government bonds sold and yields soar, something which I find very worrying. In Asia, the Korean won (-20.7%) has fallen as has its stock market, and the Malaysian ringgit (-11.1%) has fared better than copper (-25.5% in USD terms) and lumber (-61.1%, also in USD).

A litany of losers to add to commodity, equity and fixed income markets which have all taken a tumble this year. Nerves of steel required, I think.

A litany of losers to add to commodity, equity and fixed income markets which have all taken a tumble this year. Nerves of steel required, I think.

Tags: Bank of England, FX, Gilts, Pensions

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments