The Emotional Rollercoaster of Markets: Why Bubbles Repeat and How to Outsmart Them: Summary of Kim Cramer Larsson talk

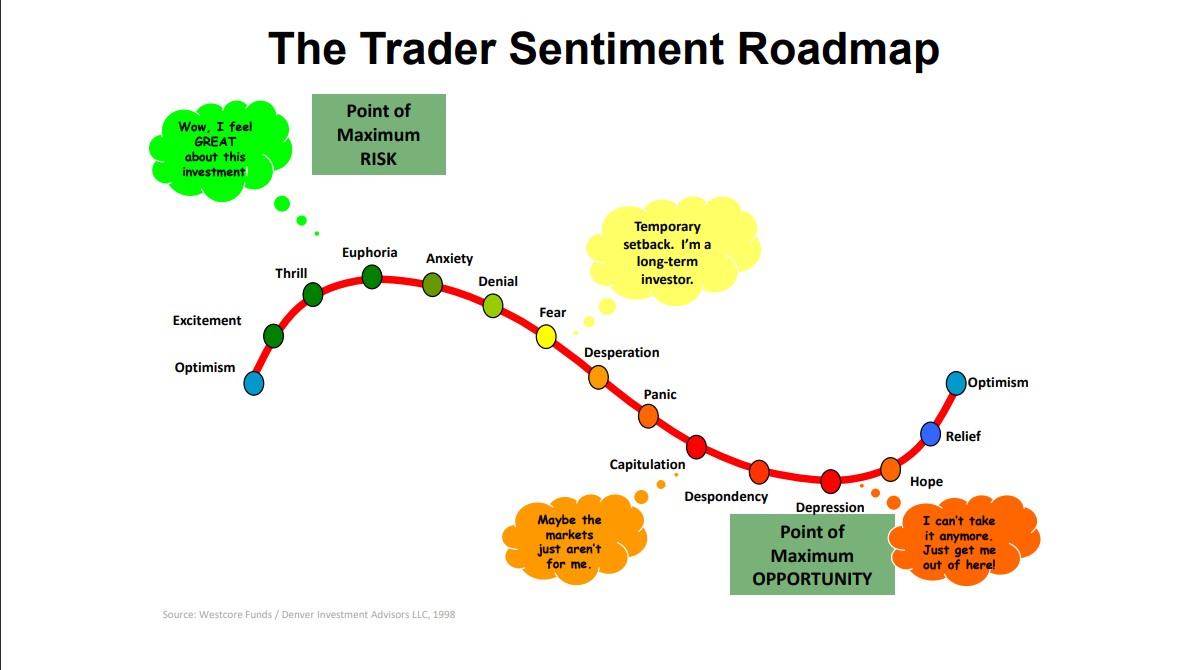

We all like to think we make rational trading decisions. But time and again, markets prove otherwise. Whether it’s the dot-com mania, Bitcoin’s meteoric rises (and falls), or the crude oil crash, bubble patterns repeat — not because of charts, but because of human behaviour.

In this powerful session, Kim Cramer Larsson, a seasoned technical analyst, took us through the anatomy of a bubble and the psychology behind why traders continue to fall for the same traps.

Bubbles Are Built on Emotion, Not Logic

From optimism to euphoria, and eventually panic and capitulation, bubbles reflect mass emotional waves. Early smart money buys in quietly. Retail investors pour in during the “mania” phase — often right before the peak. As prices collapse, fear sets in and investors hang on too long, hoping to “get back to even.”

Kim notes, “The market doesn’t have feelings — people do. And that drives everything.”

Your Brain Is the Problem

We’re hardwired to avoid losses more than we’re motivated by gains — a principle known as loss aversion. A 10% drop hurts twice as much as a 10% gain feels good. This leads to dangerous behaviour:

- Doubling down on losers

- Changing time horizons mid-trade

- Holding out of hope (not logic)

- Refusing to admit mistakes

Even your mood and hunger can impact decisions. “Don’t trade when hangry,” Kim joked — but it’s backed by real behavioural science.

Strategies for Smarter, More Resilient Trading

Kim’s advice isn’t just theoretical — it’s practical:

✅ Kill your darlings: Don’t fall in love with stocks.

✅ Set stop-losses before entering a trade.

✅ Journal everything: your rationale, your exits, your emotions.

✅ Stick to your time horizon — don’t turn day trades into long-term bag-holds.

✅ Accept small losses quickly. “The first cut is the cheapest.”

Embrace the Reality: You’re Not in Control

From illusory superiority (we all think we’re better than average) to confirmation bias and anchoring, traders routinely deceive themselves.

“Markets know everything,” Kim reminded us. “If you think you’ve found something the market hasn’t priced in, you’re probably wrong.”

The Anatomy of a Bubble — Again and Again

Kim’s talk included classic examples of bubble structures, from tulips to tech, with one twist: a stress graph from someone playing Tetris — the same pattern of rising tension and emotional collapse applies to games and markets alike.

Final Words of Wisdom

Markets may change, but human nature doesn’t. Kim closed with timeless quotes:

“Markets are never wrong — opinions are.”

“Hope burns cash.”

“The human side of every person is the greatest enemy of the average investor.”

Where to Learn More

Follow Kim’s daily technical updates and videos:

🔗 YouTube: Kramer’s Corner TA

🔗 Twitter/X: @Kramers_Corner

🔗 LinkedIn: Kim Cramer Larsson

Tags: Behavioural finance, emotial trading, loss aversion in trading, market bubbles, Sentiment, Stop-losses, Trading Discipline, Trading psychology

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Trust Me, I’m a Technical Analyst by Trevor Neil: Why Charting Is as Important Now as Ever October 15, 2025

- Why Networking Still Matters: Reflections from the STA Drinks at the National Liberal Club October 2, 2025

- Fireside Wisdom: Clive Lambert in Conversation with Tony LaPorta September 10, 2025

- Understanding Triple RSI Divergence: A Potential Warning Sign for the S&P 500 September 1, 2025

- Unlock Your Potential in Finance: Join the Society of Technical Analysts – No Qualifications Required July 24, 2025

Latest Comments