Socionomic Studies of Society and Culture: Edited by Robert R Prechter

Robert Prechter is a perennial favourite among technical analysts, having revived the work of R. N. Elliott and lectured on the subject all over the world. More recently he has been concentrating  on the Socionomics Institute, a research centre dedicated to using data on social mood to understand and anticipate social trends. His researcher Ben Hall kindly posted me a copy which I’m reviewing briefly here; it will then be donated to the STA library at the Barbican.

on the Socionomics Institute, a research centre dedicated to using data on social mood to understand and anticipate social trends. His researcher Ben Hall kindly posted me a copy which I’m reviewing briefly here; it will then be donated to the STA library at the Barbican.

At over 500 pages, it’s divided into 8 sectors starting with ‘Stardom’, through TV and Film, Construction, Transport, Industrial Safety (mercifully brief, I’d say), Business phases, Social mood, and ending with ‘Fashions and Passions’. The 80 chapters are on the whole reprints of papers from The Elliott Wave Financial Forecast, The Asia-Pacific Financial Forecast, with fresh copy from the researchers; again, chapters tend to be short. Herein lies one of the book’s problems though, in that many of the charts are not up to date today, but end when the article was written.

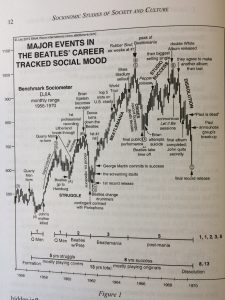

There are plenty of carefully annotated charts though, some we’ve seen before like the height of skyscrapers, others new like the sugar consumption and prices chart 1820-2020, and others unexp ected like the number of hectares burned by bushfires. It also uses photos of people, cartoons, clothes and cars showing which ones are associated with positive and which with negative social moods. He explains how prevailing moods will lead to the success of some trends and ventures which resonate with that thinking.

ected like the number of hectares burned by bushfires. It also uses photos of people, cartoons, clothes and cars showing which ones are associated with positive and which with negative social moods. He explains how prevailing moods will lead to the success of some trends and ventures which resonate with that thinking.

Depressing for any parent is the chart of the cost of an Ivy League education which travels in a north-easterly direction at a logarithmic rate. ‘A PBS Frontline documentary calls it ‘‘College Inc.’’, where for-profit colleges recruit at job fairs, encourage and arrange loans for students, deliver questionable educational value, spot high dropout rates and spend more on marketing than on teachers’ salaries.’

On a brighter note, I’d recommend this book because of the myriad ways it approaches important social issues and helps one understand the interconnectedness of these with financial conditions.

Tags: Mood, Prediction, Social Trends, Socionomics

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments