‘Talking about Risk’ – ‘’one of those topics nobody wants to talk about.’’ A webinar by Perry J. Kaufman for STA members

For an experienced market technician who prefers to stick with the trend, Mr Kaufman’s timing was impeccable. ‘’Today [10th May 2022] I bailed out of everything’’. This was because, as per his trading rules, when annualised volatility rises above 32% and he’s losing money it’s got to be done.

Looking avuncular and approachable, his clever talk with lovely slides was peppered with simple rules, common sense and down home advice. Starting first with his disclaimer, he reminds us to question everything we see and hear. Describing himself as an algorithmic trader, he creates systems (using old-fashioned FORTRAN) – and follows them. He warns against over-fitting the models as this leads to unrealistic expectations, and also overtrading.

Favouring stocks over futures (which his wife prefers being a veteran of the Chicago Mercantile Exchange) he looks to Exchange Traded Funds with decent returns. Starting off with the 20-day moving average of a stock’s Average True Range (‘’20 because it’s the smallest number that has some statistical significance’’) from this he then calculates the annualised volatility. He reminds that the smaller the price, the higher the volatility as compared to very expensive stocks.

Above all, he wants ‘’to capture the fat tail in long term trend following’’; note that his wife’s time horizon is much shorter. He continues: ‘’stocks have different personalities’’ so therefore adjust volatility filters to suit different groups and sectors and avoid trading when volatility is high. He is wary of Initial Public Offerings as there is no price history and volatility is often very high.  Meanwhile he likes some emerging market indices as these tend to be dominated by commercials and can have steady long term trends.

Meanwhile he likes some emerging market indices as these tend to be dominated by commercials and can have steady long term trends.

Though daily he scours for signals in a universe of about 500 issues, his portfolio tends to be limited to 10 different products because ‘’too much diversification ends up with a generic index type product’’. He ends: ‘’if you torture the data enough, it will tell you anything’’ – therefore ‘’keep it loose and realistic.’’

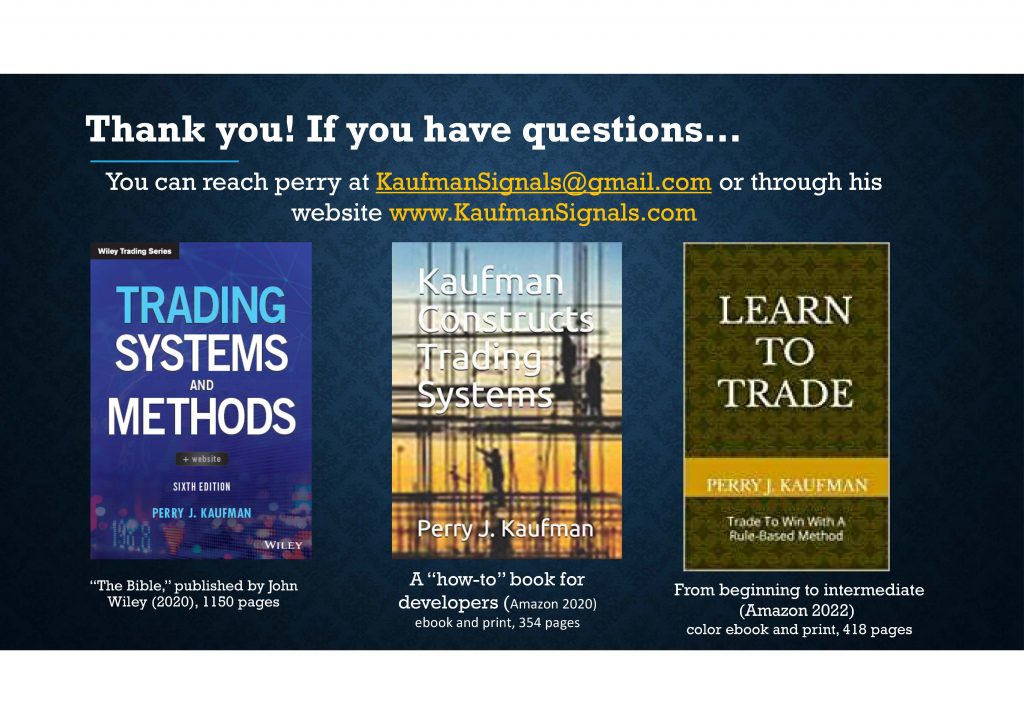

I urge members to view the video when it comes out with a pen and notepad to hand. He also said he was happy to take further questions via his email: KaufmanSignals@gmail.com

Tags: Algorithm, ETF, risk, systems, volatility

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Living in a land of large numbers: How to get a grip July 24, 2024

- Debate with ACI UK, The Broker Club & The Commodities Trading Club: Forecasts for the second half – plus marks for first half July 10, 2024

- Retail traders embrace volatility: Zero-day options and penny stocks on today’s menu June 24, 2024

- STA members and their guests get a dose of hypnotherapy June 12, 2024

- ‘And it’s a goal! Again’ Rectangles, corsets and straightjackets May 28, 2024

Latest Comments