Fireside Wisdom: Clive Lambert in Conversation with Tony LaPorta

In a recent STA fireside chat, Clive Lambert sat down with veteran trader Tony LaPorta for a candid, hour-long conversation that spanned four decades of market experience, technical analysis, and the psychology of trading. What unfolded was part masterclass, part memoir, and wholly engaging.

From the Gold Pit to Global Perspective

Tony’s journey began in 1979 on the floor of the Mercantile Exchange, where he quickly found himself on the top step of the gold pit. “The day I walked on the exchange… I’m home,” he recalled. That visceral connection to the markets has never left h im. From Chicago to London’s LIFFE floor, Tony’s career has been shaped by iconic market moments—from Black Monday to theRussian debt crisis—and by friendships forged in the chaos of live trading.

im. From Chicago to London’s LIFFE floor, Tony’s career has been shaped by iconic market moments—from Black Monday to theRussian debt crisis—and by friendships forged in the chaos of live trading.

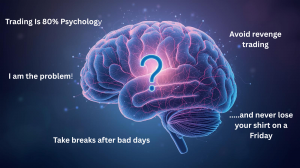

Trading Is 80% Psychology

One of Tony’s core messages was clear: technical analysis is a tool, but trading success is psychological. “I am the problem,” he said. “They don’t click the mouse—I click the mouse.” His advice? Take breaks after bad days, avoid revenge trading, and never lose your shirt on a Friday—a phrase born from a $520,000 loss that followed a $580,000 gain.

Voodoo Lines and Tape Reading

Tony’s technical toolkit includes the mysterious “Voodoo Lines”—Elliott Wave-based support and resistance levels that have guided him through volatile markets. While he didn’t invent them, he swears by their predictive power. “I just know how to trade a route,” he said. Clive, ever the technician, offered complementary insights on head-and-shoulders patterns and trendlines, sparking a rich discussion on how textbook setups often get retested before the real move begins.

Addendum: Voodoo Lines are a proprietary technical indicator developed by Simpler Trading to identify long-term support and resistance levels. Based on historical price action and Elliott Wave analysis, these static lines remain consistent over time—often for years—providing traders with reliable reference points for anticipating market reversals or continuations.

Correlations, Coffee, and Cutting Size

Tony’s approach is deeply rooted in correlation trading. Whether it’s gold vs. silver or Nasdaq vs. S&P, he watches for divergences that signal opportunity. He also emphasized the importance of cutting position size in difficult markets—a lesson he’s passed on to farmers, grain traders, and equity players in his Discord chatroom.

Community and Conversation

Community and Conversation

The chat wrapped with reflections on the value of community. “When we worked on the floor, you had ten different people to share ideas with,” Tony said. His chatroom is an attempt to recreate that camaraderie. And yes, he still hands out $2 bills to friends—a lucky charm and a conversation starter.

Final Thoughts

This fireside chat was more than a trip down memory lane—it was a reminder that markets may change, but the human element remains constant. Tony’s stories, Clive’s insights, and their shared respect for technical analysis made for an evening that was equal parts entertaining and educational.

If you missed it, keep an eye out for future STA events. And if you’re curious about Tony’s work, his charts and commentary are available at https://tonylaporta.com/ —with a generous trial offer for STA members.

Tags: FuturesTrading, MarketWisdom, trading, TradingPsychology, VoodooLines

The views and opinions expressed on the STA’s blog do not necessarily represent those of the Society of Technical Analysts (the “STA”), or of any officer, director or member of the STA. The STA makes no representations as to the accuracy, completeness, or reliability of any information on the blog or found by following any link on blog, and none of the STA, STA Administrative Services or any current or past executive board members are liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. None of the information on the STA’s blog constitutes investment advice.

Latest Posts

- Fireside Wisdom: Clive Lambert in Conversation with Tony LaPorta September 10, 2025

- Understanding Triple RSI Divergence: A Potential Warning Sign for the S&P 500 September 1, 2025

- Unlock Your Potential in Finance: Join the Society of Technical Analysts – No Qualifications Required July 24, 2025

- Navigating Mid-2025: Inflation, Markets, Commodities & Strategic Outlooks July 10, 2025

- Why Your Post-Nominals Matter: MSTA & FTSA July 3, 2025

Latest Comments